News

As 2023 draws to a close the wine market has seen a very complicated year. The top traded wines for Capital Vintners have seen a very big challenge to say the least.

Prestige Champagnes experienced significant price adjustments after a substantial surge in a bullish market throughout 2021 and most of 2022.

The Liv-ex Champagne 50 index declined by 17.2% in the first 11 months of 2023, yet it still maintained a 53% increase over the past five years.Champagnes took the lead as the most-traded wines on Liv-ex in the current year. Louis Roederer’s Cristal 2015 claimed the top spot in terms of trade value, closely followed by Dom Pérignon 2013. Despite being released earlier in 2023, both wines saw a decline in their Liv-ex market prices throughout the year. For instance, Dom Pérignon 2013 dropped from £1,830 in January to £1,646 (12x75cl in bond) in December.

Other highly traded wines by value included Opus One 2019, Cristal 2014, Screaming Eagle 2020, Sassicaia 2019, Château Lafite Rothschild 2019, Château Lafite Rothschild 2010, Petrus 2020, and Taittinger, Comtes de Champagne 2012.

In terms of volume, the top-traded wines on Liv-ex in 2023 were Dom Pérignon 2013, Cristal 2015, Taittinger, Comtes de Champagne 2012, Cristal 2014, and Château Talbot 2020 (Bordeaux fifth growth).

Interestingly, Liv-ex noted a resurgence in Bordeaux’s share of trades for the first time in a decade, attributing it to a ‘flight to quality’ amid uncertain times. Bordeaux constituted approximately 40% of trades by value on Liv-ex in 2023 year-to-date, marking a slight increase from 2022 but still below its 80% share a decade ago.

The market continues to grapple with ongoing price pressure, and it remains uncertain when the secondary market will reach its bottom.

Liv-ex anticipates prices to remain under short-term pressure until a compromise is reached between buyers and sellers amid the current impasse. Despite the challenging market conditions, some buyers are still participating in auctions.

An online auction house, projects an overall increase in Champagne sales volume in 2023, accompanied by a decrease in the average bottle price.

After various talks over the last few months with various other similar companies it is suggested that the market might be nearing its lowest point in the current downturn, but a recovery would depend on factors such as changes in interest rates impacting discretionary spending on fine wine.

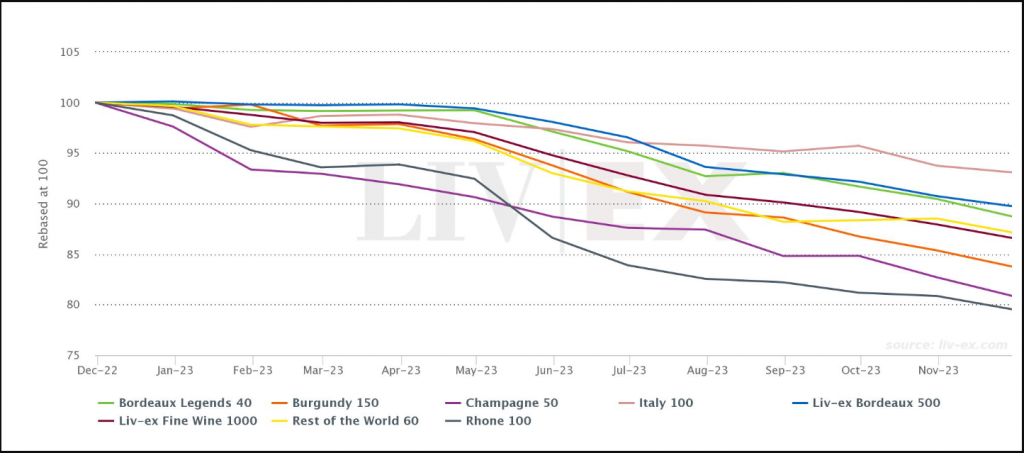

Performance of Liv-ex 1000 regional sub-indices in 2023

This week

Bordeaux rebounds as other regions dip

Source: Liv-ex 15/12/2023

Bordeaux dominated trade this week, all other regions experiencing a dip except for the Rhône and Piedmont. The most traded wines by value and volume hailed from Bordeaux, Champagne and Tuscany. This week, Liv-ex published indices update and its December Market Report as well as technical analysis of the Liv-ex 1000 and 50. Bordeaux’s share of trade rebounded for the seven days ending 14th of December, rising to 41.3% from 27.5% last week. Château Lafite Rothschild 2019 was particularly active, buoying the region’s share of trade, as were several vintages of Château Latour.

As a result, most other regions’ trade shares declined week-on-week. Burgundy went from 27.5% to just 21.0% of the total this week, despite several wines from Domaine de la Romanée-Conti changing hands. Tuscany also fell from 10.6% of the total to 7.2% this week, and Champagne from 16.6% to 13.4%. The Rhône and Piedmont were the only other two regions to experience an uptick, rising to 2.9% and 6.0% of the total respectively.

Key Findings from the National Statistics Government Website:

The UK gross domestic product (GDP) is reported to have experienced no growth in Quarter 3 (July to Sept) 2023, following a slight increase of 0.2% in the preceding quarter.

Quarter 3 of 2023 saw a 0.6% increase in GDP compared to the same quarter in the previous year. In terms of output, the services sector witnessed a 0.1% decline, offsetting a 0.1% rise in construction output, while the production sector remained relatively stable.

In expenditure terms, the growth in net trade volume was counteracted by declines in business investment, household spending, and government consumption.

The implied GDP deflator, a measure of inflation, rose by 7.9% compared to the same quarter a year ago.

This increase was primarily influenced by a decrease in the implied price of imports, contributing positively to the overall GDP deflator.

Headline GDP Figures The UK GDP is estimated to have shown zero growth in Quarter 3 of 2023, following a 0.2% increase in the previous quarter (Figure 1). Compared to the same quarter the previous year, GDP is reported to have grown by 0.6% in Quarter 3, with adjustments made for the additional bank holiday in 2022 due to the State Funeral of Her Majesty Queen Elizabeth II.

It’s important to note that these early GDP estimates are subject to revision, and the impact of the State Funeral bank holiday should be considered when interpreting seasonally adjusted movements involving September 2022 and, to a lesser extent, Quarter 3 of 2022.

The GDP Monthly estimates released on November 10, 2023, indicate a 0.2% increase in GDP for September 2023, following a revised-down growth of 0.1% in August (initially reported as 0.2%) and an unrevised 0.6% fall in July 2023.

Source: National Office of Statistics

Hangover News:

While some of the years news on the wine market may lead you to drink a glass of red wine it might be note-worthy to point out below:

New Study Sheds Light on Red Wine Headaches Scientists may have uncovered a solution to a longstanding mystery regarding headaches induced by red wine consumption, as recent research points to a natural grape component as a potential trigger for some individuals.

Researchers, including scientists from the University of California Davis, have made a breakthrough in understanding why certain people may experience headaches after drinking red wine.

The study, published in Scientific Reports, suggests that a specific phenolic compound naturally found in red wines might be linked to a mechanism that initiates headaches.

Approximately 16% of the global population experiences headaches daily, with alcohol known to be a headache inducer in large quantities. However, the study highlights that even moderate consumption, such as one or two small glasses of red wine, can lead to headaches within 30 minutes to three hours for some individuals.

While previous research in 2008 identified the phenomenon, no specific chemical culprit or mechanism had been pinpointed until now.

The study explores the flavanol quercetin, present in varying amounts in red wines, as a potential disruptor of the body’s ability to metabolize alcohol. Quercetin, considered a healthy antioxidant in fruits and vegetables, including grapes, may interfere with alcohol metabolism, leading to the accumulation of the headache-inducing toxin acetaldehyde.

Wine chemist and study coauthor Andrew Waterhouse explained that when quercetin enters the bloodstream, the body converts it into a form called quercetin glucuronide, which impedes alcohol metabolism. This, in turn, results in the build-up of acetaldehyde, known to cause headaches and nausea. The study suggests that individuals with pre-existing migraine or headache conditions may be more susceptible to this issue.

While the researchers acknowledge the need for further clinical trials to validate their hypothesis, they believe they are making progress in unraveling the age-old mystery of red wine headaches. Morris Levin, professor of neurology and director of the Headache Center at the University of California, San Francisco, emphasized the importance of scientific testing on individuals who experience these headaches to confirm the findings.

November 2023

Prominent Taiwanese Collector Unveils £50 Million Wine Cellar for Sale

Pierre Chen, a Taiwanese billionaire renowned for his success in the electronic components industry, has decided to part with his extensive wine collection in a monumental auction by Sotheby’s. Beyond his electronic ventures, Chen is notably passionate about two realms—wine and art, as showcased in the Tate Modern’s exhibition “Capturing the Moment” until April 28 of the following year.

The auction, titled “The Epicurean’s Atlas,” is set to feature around 25,000 exquisite options and will span six auctions across France and Hong Kong. Chen’s collection encompasses an array of prestigious wines, including gems like the 2001 Vosne-Romanée Cros-Parantoux 1er Cru from the late Henri Jayer and the 1971 Salon le Mesnil champagne. Magnum selections from renowned Bordeaux châteaux, such as the 1961 Château Latour and the 1982 Château Pétrus, will also be part of the auction, with the Pétrus presented in a six-liter imperial. Sotheby’s estimates this to be the most extensive and valuable wine collection ever to hit the market, with a pre-sale valuation of $50 million.

Chen, known for frequenting some of the world’s finest restaurants like Noma in Copenhagen and the French Laundry in California, views wine not merely as a standalone pleasure but as an integral part of the overall gastronomic experience. His belief in the ethos of drinking, sharing, and experiencing wine has led him to initiate this auction.

For those contemplating participation, Nick Pegna, Sotheby’s global head of wine and spirits, advises prospective bidders to be well-prepared. Pegna suggests determining bidding limits in advance and placing advance bids, considering the fast-paced nature of sales rooms. Additionally, he emphasizes the importance of assessing the ullage levels of older wines, which can provide insights into their overall quality and storage conditions. Potential buyers are cautioned to be vigilant about seepage, an indication of potential wine damage, and are encouraged to explore lots with damaged labels or mixed selections, which may offer good value. Lastly, Pegna underscores the safety and reliability of reputable auction houses and commends collectors like Chen for the meticulous care demonstrated in curating their collections.

Source: The Times

Bordeaux News:

Bordeaux dominated trade this week, all other regions experiencing a dip except for the Rhône and Piedmont. The most traded wines by value and volume hailed from Bordeaux, Champagne and Tuscany. This week, Liv-ex published indices update and its December Market Report as well as technical analysis of the Liv-ex 1000 and 50. Bordeaux’s share of trade rebounded for the seven days ending 14th of December, rising to 41.3% from 27.5% last week. Château Lafite Rothschild 2019 was particularly active, buoying the region’s share of trade, as were several vintages of Château Latour.

As a result, most other regions’ trade shares declined week-on-week. Burgundy went from 27.5% to just 21.0% of the total this week, despite several wines from Domaine de la Romanée-Conti changing hands. Tuscany also fell from 10.6% of the total to 7.2% this week, and Champagne from 16.6% to 13.4%. The Rhône and Piedmont were the only other two regions to experience an uptick, rising to 2.9% and 6.0% of the total respectively.

Sourcce: Liv-ex

Primary Market Influencers

The market dynamics

During November, every sub-index within the Liv-ex 1000 experienced a decline. The decreases varied, with the Italy 100 observing a modest 0.7% dip, while the Champagne 50 faced a more substantial 2.2% reduction.

Within the Liv-ex 1000, encompassing a comprehensive market overview, 300 wines witnessed an increase in their Mid-Prices on a monthly basis. Simultaneously, 180 remained stable, and 520 exhibited a decrease. Analyzing the components of the index that rose or fell provides limited coherence.

Among the notable underperformers in the index are three Le Pin vintages, with the 2000 witnessing a substantial 21.6% decline month-on-month, followed by the 2014 with a 17.8% decrease and the 1998 with a 13.6% fall. Additionally, ten Bordeaux wines experienced double-digit declines in the past month.

Five wines from Domaine de la Romanée-Conti also experienced a monthly Mid-Price decline exceeding 10%: Grands Echezeaux Grand Cru 2012 (-17.8%) and 2018 (-11.7%), Romanée-Conti Grand Cru 2012 (-14.4%), La Tâche Grand Cru 2013 (-13.9%), and 2019 (-13.5%).

At the pinnacle of the index’s noteworthy performers are several Rhône labels, including Paul Jaboulet Aîné, Hermitage, La Chapelle Rouge 2013 (+14.9%).

Château Mouton Rothschild 2021.

On December 1st, Château Mouton Rothschild unveiled the new design adorning its 2021 vintage bottles, which was created by the Japanese artist Chiharu Shiota. According to the press release, the label depicts a silhouette representing the beauty and abundance of nature while emphasizing the delicate balance between nature and humanity.

Following the customary announcement of the new label, an auction took place at Christie’s, featuring various formats of Château Mouton Rothschild 2021. The auction included six bottles, three magnums, a double magnum personally signed by the artist and the Rothschild family, an imperial size, as well as the sole Nebuchadnezzar of the wine available.

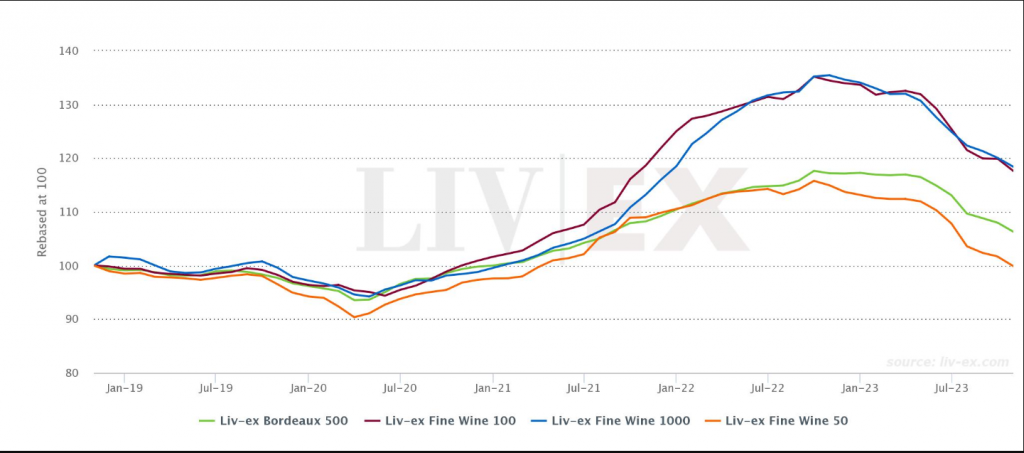

The 2023 edition of the Liv-ex Power 100

Featured in The Drinks Business Magazine’s December issue. This annual report highlights the most influential brands in the fine wine market. In contrast to the previous year’s findings that hinted at an imminent slowdown, this year’s report reflects a market deeply engaged in a price correction. With major Liv-ex indices retracing over 12% year-on-year and the Bordeaux 500 nearing double digits, the market witnessed a substantial shift. Unlike the previous year, 54 brands within the Power 100 experienced negative price performance.

Amid growing risk aversion, collectors directed their attention to the highest quality wines, focusing on both brand and vintage levels. Consequently, the number of brands qualifying for the Power 100 decreased by 2.1% this year, yet a substantial 414 brands remained in contention.

The data considered spans from October 1, 2022, to September 30, 2023, with rankings determined by various weighted criteria, including price performance, a brand’s wine trading volume, and the cumulative value and volume of trades during the specified period. See the image below source from Liv-ex